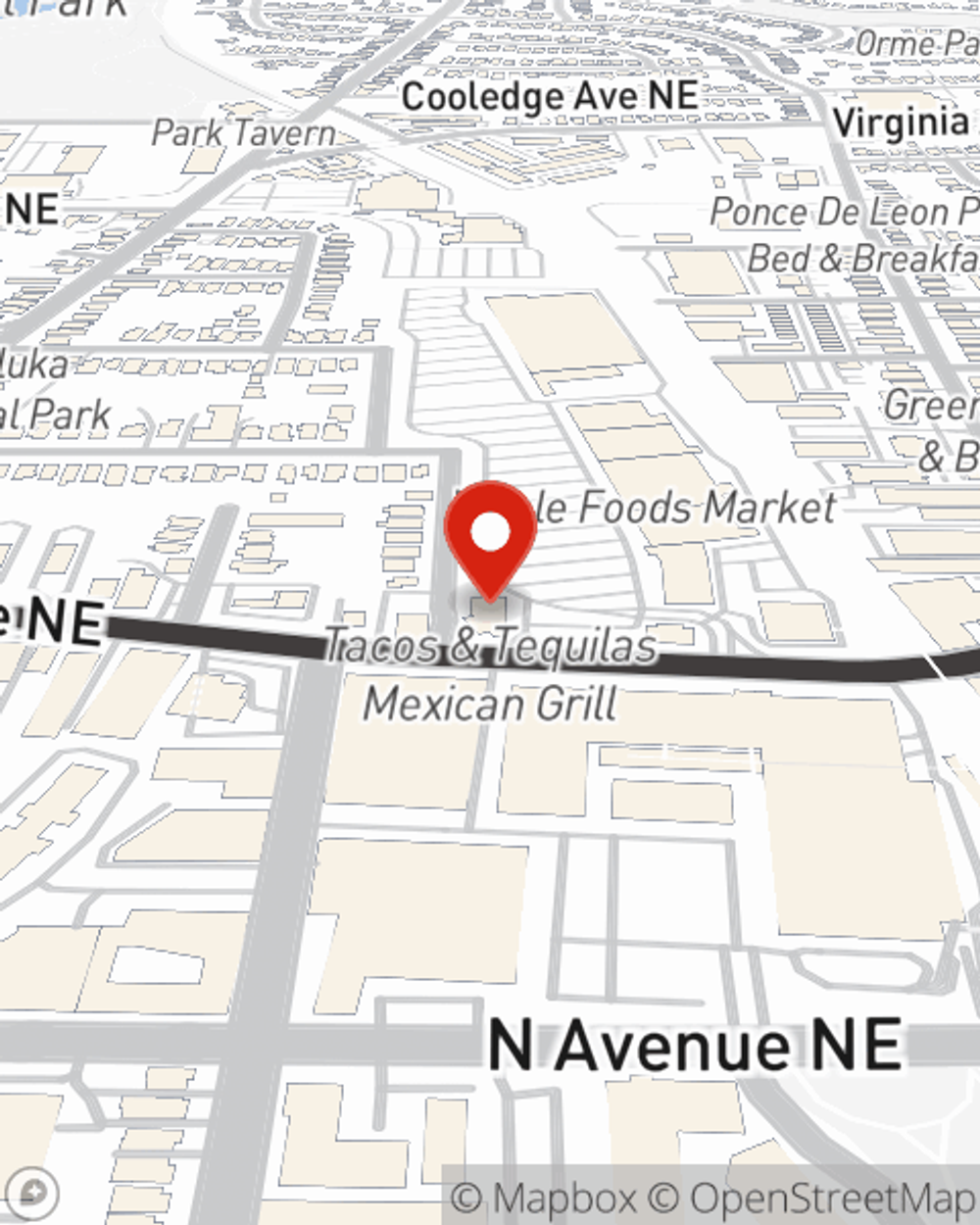

Business Insurance in and around Atlanta

Calling all small business owners of Atlanta!

This small business insurance is not risky

Coverage With State Farm Can Help Your Small Business.

You may be feeling overwhelmed with running your small business and that you have to handle it all alone. State Farm agent Chad Powell, a fellow business owner, is aware of the responsibility on your shoulders and is here to help you personalize a policy that's right for your needs.

Calling all small business owners of Atlanta!

This small business insurance is not risky

Surprisingly Great Insurance

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is temporarily closed. It not only protects your income, but also helps with regular payroll costs. You can also include liability, which is critical coverage protecting your business in the event of a claim or judgment against you by a customer.

When you get a policy through one of the leading providers of small business insurance, your small business will thank you. Call or email State Farm agent Chad Powell's team today to discover your options.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Chad Powell

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.